Forecast: retail growth to drop during holiday season 2022 while ecommerce continues to grow

For many brands, the end-of-year holiday season truly is, in the words of the great Andy Williams, “the most wonderful time of the year.” In the U.S., the holiday shopping season is starting earlier than ever, which means marketers need to implement their holiday shopping campaigns and tactics even sooner. Driven by price sensitivity in the wake of rising inflation, as well as ongoing supply chain concerns, consumers are taking more time to shop, hoping to find the best deals from retailers and ecommerce brands that continue to compete for Americans’ wallets.

So, the big question is: when should marketers start thinking about capturing consumers for holiday shopping?

Answer: right now.

The (ongoing) rise of ecommerce

Throughout the last three years, worldwide ecommerce spending has skyrocketed as consumers and brands alike have gotten increasingly comfortable with online shopping during the COVID-19 pandemic. Growth hasn’t been limited to just online shopping though; holiday retail sales volume in Q4 2021 reached its highest point ever, even on the back of ongoing record growth (over 14% YoY) (National Retail Federation). However, as inflation hits U.S. consumers, projections from Deloitte estimate that holiday sales in 2022 will grow only 4%–6% YoY (Retail Dive). Yet at the same time, some projections say that ecommerce sales will grow by 12%–14% YoY, a huge increase over 2021’s growth of 8.4% (Retail Dive). This gap in spending behavior is dramatic and very telling: consumers prefer to shop online.

So, while the overall retail opportunity may be smaller in Q4 2022 than previous years, brands are still likely to see record growth via online channels.

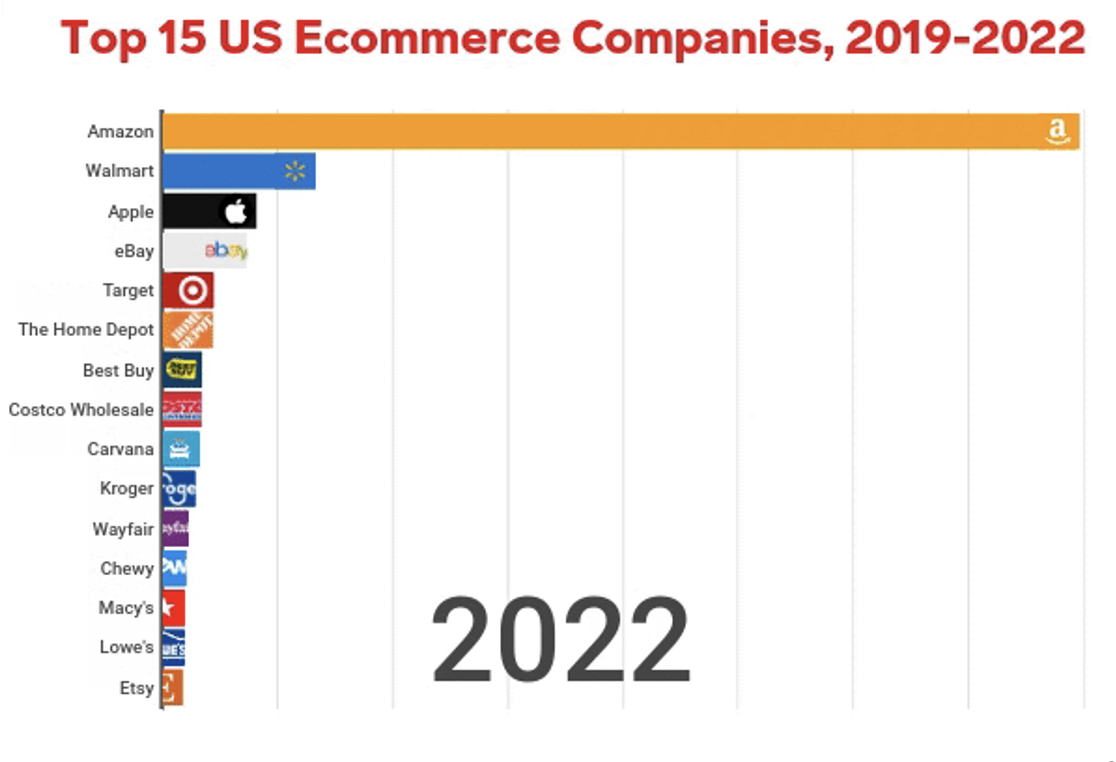

Amazon’s Prime Day, historically a summer affair, was shifted to October in 2020. And in 2022, despite already running Prime Day in July, Amazon is capitalizing on its reigning superiority by offering even more deals at a second event in October. But Amazon has one big weakness: it does not yet have a large physical store offering. As Amazon works to increase its brick-and-mortal presence, large, established retailers like Target and Walmart are pushing hard to break through by offering new services and ways to buy, such as online shopping with same-day in-store pickup. These retailers are also taking steps to compete with Amazon by offering their own shopping extravaganzas to steal back some market share from Amazon’s yearly Prime Day event.

Similarly, advertising platforms are working to increase their own marketplace offerings to take on Amazon. Meta’s Shops has been around for several years now but has seen increased brand adoption as off-platform measurement becomes more difficult in the wake of privacy-centric measures like iOS 14 and the ongoing deprecation of third-party cookies. TikTok Shopping ads are in beta and available to select advertisers for testing. Even Twitter is joining the fray, announcing their own shopping ad format this summer.

While Amazon still reigns king, a rising tide raises all ships. Marketers can ensure their brands rise as well by starting to test and invest in both existing and new channels while they are still on the upswing.

Events to watch

Amazon’s Prime Day, Part Deux: October 11–12

Prime Day used to be a single day when it launched in July 2015. Then in 2019, it became a two-day shopping event. In 2020, due to the (then new) COVID-19 pandemic, Amazon delayed Prime Day from its usual summer schedule, opting instead to launch the event in October of that year, but returning it to its summer timeslot in 2021. This year, however, marks the biggest shift to Prime Day since it launched in 2015: a second Prime Day. Amazon is technically calling this event the Prime Early Access Sale, and it’s scheduled to run October 11–12. Name aside, marketers can think of this simply as Prime Day, Part Deux.

Target Deal Days October 6–8

Target launched Deal Days in July 2019 as a direct response to Amazon Prime Day. Unlike Amazon’s event, Deal Days is open to all shoppers, with no paid membership needed to access all of Target’s offers. Also, unlike Amazon, selling on Target.com is currently invite-only as part of its Target Plus program; however, the retailer plans to start accepting applications in the future. If you’re not selling at Target already, Deal Days may not pique your interest this year (but make sure to keep it in mind for 2023 as Target continues to expand its ecommerce offerings).

Black Friday and Cyber Monday

Don’t worry if you haven’t prepared for early October’s big events; the “Turkey-5” is still likely to be one of the biggest shopping weeks of the year, despite some predictions that sales on Black Friday will drop 7% YoY (Adobe Analytics). Although overall sales might drop some as consumers shop earlier in the season, ecommerce sales on Black Friday are still likely to remain strong as many large retailers, such as REI and Target, continue to close physical stores for the Thanksgiving holiday.

Are you prepared for this year’s holiday season? With the kick-off time approaching quickly, here are three quick wins to make the most of the season.

Double check your product listings

A straightforward way to drive more sales is to ensure your product feeds are optimized for success. Whether you sell on Amazon, Google Shopping, or Meta Shops, a clean, organized, informational product listing can make all the difference. Make sure your listings address core customer needs by:

- Reviewing your ecommerce shop’s (if you have it) internal search data to see how shoppers browse your products

- Checking customer feedback on Amazon and other marketplaces to address core complaints or highlight benefits your customers are raving about

- Reviewing products from other brands for messaging opportunities to better compete in search results

- Ensuring your top sellers’ inventory is high enough to support potential increased purchase volume

Increase your advertising budget

The holiday shopping period offers a huge opportunity to increase new customer acquisition and drive sales, but competition is heating up, especially on marketplaces like Amazon. Make a plan with your leadership to ensure you have flexibility to scale budgets if sales or profits are meeting or exceeding expectations. That said, don’t be afraid if return on ad spend (ROAS) falls as you scale; be prepared to possibly accept lower profitability in favor of stronger overall sales and potential long-term gains driven by new purchasers who may turn into repeat customers.

Test new social shopping channels like TikTok or YouTube Shorts

Social channels can drive significant purchase intent, with over 47% of Instagram, TikTok, and YouTube users saying that they “sometimes” or “all of the time” buy products seen on those platforms (eMarketer). Investing in new channels can be daunting, especially as fears of a recession may be leading to budget cuts within organizations. However, it’s still worth considering a test of these new channels as consumers increasingly look to social media for guidance on what new products to buy.

Here’s the TL;DR

Retail growth is likely slowing, but brands should continue to invest in ecommerce

Yes, inflation is scary. Yes, supply chains are still a little crazy. Yes, consumers aren’t buying quite as much or as often as they were in the past. But the big platforms and brands like Amazon, Facebook, TikTok, and Target are all doubling down on their ecommerce offerings as consumers continue turn online to find their holiday items.

Marketers should expect a lower revenue holiday season compared to what we’ve seen throughout the pandemic, but that doesn’t mean it’s time to slow down on advertising and marketing initiatives. On the contrary: as competition for American dollars heats up, advertisers that provide a strong online shopping experience and consistent product offerings, and maintain (and expand) visibility on performance/awareness channels, are likely to see continued ecommerce growth.