Google Rolls Back Search Term Visibility

On September 1, Google announced it will reduce visibility in the search terms report within Google Ads. The search terms report allows advertisers to see which search queries triggered their ads, providing insight into how closely users’ searches relate to keywords an advertiser targets within their campaigns. In its announcement, Google indicated that going forward, the report will only include terms that were used in a “significant” number of searches, even if a “less significant” term received a click. This means that advertisers will not be able to see all of the terms that triggered their ads, even if they were charged for a click from those queries.

The change to the search terms report comes on the heels of a series of privacy laws recently enacted – think GDRP in Europe in 2018, and the CCPA in California which started this past July. Google says the move is to strengthen protections around user data by keeping advertisers from using any personally identifiable information included in search queries. Of course, this isn’t the first time Google has made such a move – it has been limiting organic search query data in Search Console dating back to 2011.

Google has been less than transparent about the new volume threshold for search terms, creating speculation about what a “significant number” of searches means. A number of advertising publications have estimated the change will cause advertisers to lose visibility into 20% of search terms, but we wanted to investigate this ourselves. So, we conducted an analysis of client accounts pre- and post-change to verify the impact in real life.

It’s true: we found a significant loss in search terms data

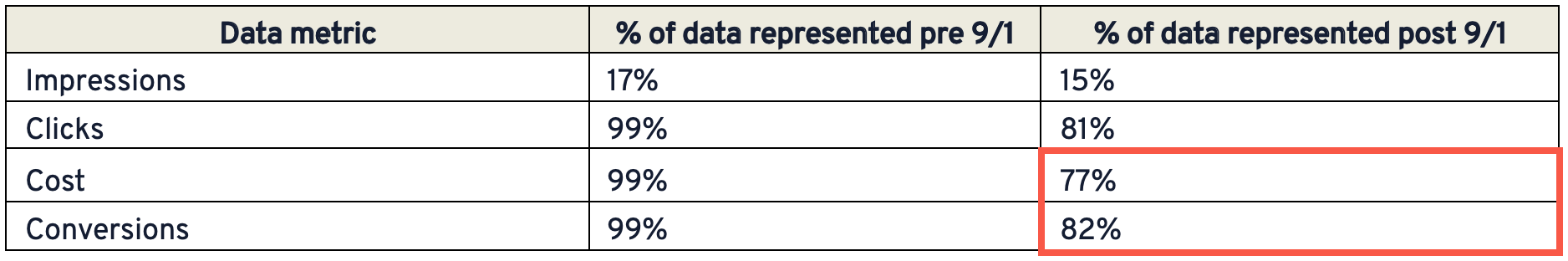

Overall, after reviewing data across client accounts, we can confirm the loss of visibility in search terms data. Below is an example of one data set to illustrate the change. It’s worth noting that impression data didn’t change significantly because Google was already filtering out data for queries that drive impressions but not clicks. And while the data pulled from other metrics also suggest that Google was already removing some low-volume, zero-click search terms, there was a significant reduction in visibility to data – roughly 20%.

The changes to cost and conversion data reveal the significant impact of the new limits to data visibility. In this example, nearly $3,500 a day in media spend is no longer visible in the search terms report. Annually, this could amount to upwards of $1.3M in spend for which Google no longer provides the same level of visibility.

Why does it matter?

As the data shows, losing insight into around 20% of searches will have a significant impact on reporting, daily optimizations, and ultimately paid search strategy for advertisers moving forward. Some key examples?

- Less insight means a decreased ability to mine keywords for new ways that audiences are searching. This tactic has often been used, among other things, to refine targeting and improve performance.

- It also limits negative keyword management. Negative keywords can be added to a campaign to block terms for which an advertiser doesn’t want to show ads (think irrelevant terms or competitors). Without visibility into a significant portion of search query data, it will become more difficult to weed out terms that are irrelevant to a given business.

The change to the search terms report begs the question: who owns the data? Is it the advertiser or the publisher? And who gets to determine what constitutes personally identifiable information? At present, the lack of transparency from Google about which types of searches it categorizes as too personal and the criteria it’s using is very unclear. Being compliant with GDPR and CCPA standards is critical, and both advertisers and publishers must do everything they can to stay in compliance. However, there is still a lot of grey area around privacy that gives publishers the power to make these types of decisions without always articulating all the supporting details.

What does this mean for marketers?

As Google continues to restrict access to data, there will be huge implications on how and when marketers will need to leverage automated policies – decreased access to data makes deriving performance insights harder, and that means search marketers will need to rely more heavily on Google’s technology for those insights and optimizations. This dynamic will undoubtedly evolve as advertisers continue to push for access to the data they pay for and publishers continue to make changes to policies as more legislation passes around privacy.

If you’re panicking, you can take a deep breath. It’s not all doom and gloom for your search campaigns. But it is time to pivot your search strategy.

What can you do?

While the change to the search terms report is significant, there are ways advertisers can adjust their strategy to still acquire the valuable information needed to make optimizations and maximize performance.

- Launch dynamic search ad (DSA) campaigns to help mitigate the decrease in visibility of low-volume keywords. While the change to the search terms report affects DSA queries too, the vast majority of the query data driven by these campaigns will still be specific long-tail searches that marketers can mine for new keywords to target.

- Utilize automated bidding technology to optimize campaigns for lower volume queries. Even though all queries won’t be visible in the search query report, Google’s bidding algorithms are still collecting that data and optimizing campaigns based on the goals and parameters you have set.

- Ensure there is symmetry between your Google and Bing (Microsoft Ads) campaigns. Microsoft Ads hasn’t announced any changes coming to its search terms report (…at least not yet), so having the same campaign structure across platforms can provide insight into some of the lower volume queries that are missing from the Google Ads search terms report.

- Leverage the keyword planner and other tools to help with keyword mining and gathering insights on general search trends.

- Maintain a strong and active negative keyword management approach to ensure your brand is showing for searches that are relevant and driving qualified site traffic.

Final takeaways

While Google is limiting the amount of data available in the search query report, there are still ways to utilize the tools available to gather insightful learnings and continue to optimize campaigns for improved performance. But as more policies are created around user privacy and the handling of data, advertisers can expect more changes in the future around data collection and how data can be used. For that reason, it’s crucial to remain flexible and stay current with policy updates.

Image Source: Unsplash