An Advertiser’s Guide to the OTT & CTV Landscape

Top disruptors: OTT & CTV

Gone are the days of broadcast, satellite, and cable (otherwise known as traditional linear TV) being the only way to access television content. Television has become more complex over the years as internet-based options have expanded, including the development of over-the-top content and connected TVs. With the rising popularity of these video tactics, advertisers must fully understand what they mean in order to effectively & efficiently reach consumers.

Let’s start with the basics. Over-the-top (OTT) content refers to any internet-based TV program or movie that bypassess broadcast, satellite, and cable television. OTT content is most commonly streamed on connected TV (CTV) devices, which are internet-connected televisions capable of streaming video content through a variety of services and apps. Examples of over-the-top content include popular streaming apps like Hulu and Tubi, which can be accessed via connected TVs (think smart TVs) or via devices that plug into TVs, such as a Roku or Amazon Fire sticks.

OTT services

As OTT content has become more accepted by consumers who value cost-effective ad-supported options, new opportunities have developed for marketers to reach relevant audiences via streaming. There are multiple types of OTT services that advertisers can leverage, including:

- Free ad-supported TV (FAST): type of service where users don’t pay a fee at all, and the service delivers scheduled programming (most akin to live linear television). The top platforms that fall into this category are Pluto and Samsung TV Plus.

- Advertising video on-demand (AVOD): type of service where users don’t pay a fee at all, and the user picks what specific piece of content they want to watch (more akin to Hulu if it were completely free, where you select a movie or show to watch. Tubi and YouTube are prime examples of this service.

- Subscription video on-demand (SVOD): type of service where users enter into a subscription agreement and pay a recurring fee that grants them access to watch content with no limits. “HVOD” is becoming a term for hybrid video on-demand that offers both ad-free and ad-supported content. Ad-free Netflix, Prime Video, Disney+, and HBO Max are leaders of SVOD.

- Virtual multichannel video programming distributor (vMVPD): provides multiple broadcast TV channels just as you would get from a cable or satellite provider. Key examples are YouTube TV, Sling, and fuboTV.

With all these options, it’s vital that advertisers understand how and where their consumers are watching TV in order to effectively reach their target audience.

OTT consumption & ad trends

As consumers become more tech savvy, it should come as no surprise that internet-based streaming services (OTT) would eventually surpass linear TV in terms of reach. According to Nielsen, streaming’s share of viewership has already surpassed broadcast & cable television, but has not yet surpassed traditional linear television as a whole. In November 2022, 38% of TV consumption came from streaming, compared to 32% from cable and 26% from broadcast.

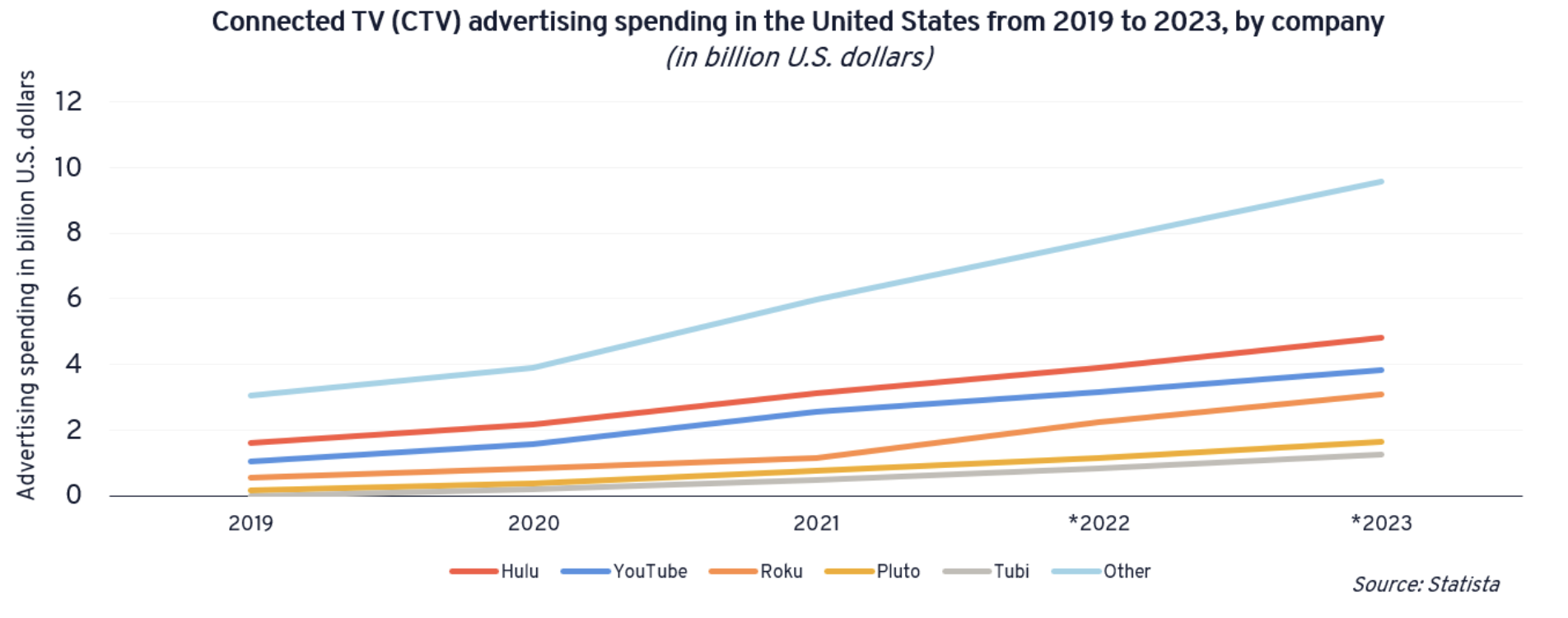

But where are consumers streaming their television content? According to Statista, five streaming services (Hulu, YouTube, Roku, Tubi, Pluto) have dominated ad investment in recent years, although network-specific streamers (such as Peacock & Discovery+) as well as Netflix are looking to disrupt this space.

What this means for advertisers

As more ad-supported streaming services are introduced each year and the market grows increasingly fragmented, it’s important for brands to be running ads on the streaming services their audience is using. But because no brand can be everywhere at once, a strategic media plan focused on key audiences is vital. Collective Measures recommends sticking with well-established demand side platforms (DSPs) like The Trade Desk and focused direct buys with ad-supported streaming services who can offer scale, a range of targeting options, and advanced measurement to ensure media effectiveness. In the end, the good news is that the often overwhelming variety of streaming platforms gives advertisers countless options to reach their audience.