When it comes to shopping, different platforms offer consumer research products, for example, Pinterest, Etsy, Amazon, Google, or directly on a retailer’s site. However, Amazon has become the go-to space to start the research process. In fact, a recent “State of Amazon” study by BloomReach found that now 55% of consumers turn to Amazon first when searching for products online. This is the first time the study has found Amazon leading Google for product searches and demonstrates Amazon’s influence on consumer behavior.

Amazon Leads in Product Searches

Consumers are turning to Amazon first for comparison shopping and researching products before purchase. What keeps consumers coming back to Amazon is the positive site experience, from ease of searching to ease of buying. For years, Amazon has provided a personalized shopping experience and now has been perfecting the simplicity of buying products. The ecommerce giant has launched one-click buying, dash buttons, and even Amazon Now with 2-hour delivery. All features are built to make a positive and convenient experience with Amazon.

Amazon Advertising Platform

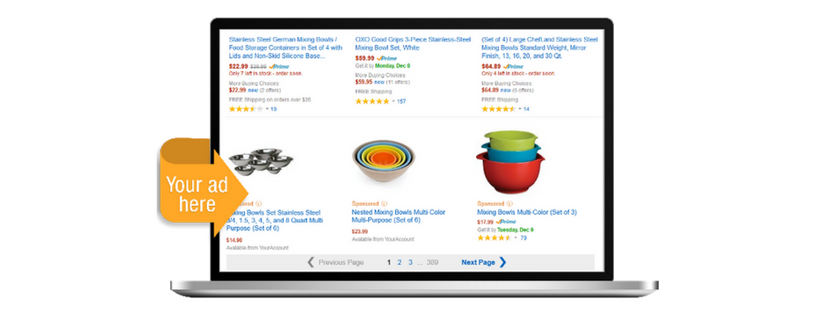

Beyond Amazon taking a big share of consumer product searches, Amazon also competes with Google from an advertising perspective with its Advertising Platform. Amazon features paid search capabilities (sponsored products and sponsored links) within its own search results based on keyword targeting. Amazon will match what a user is looking for via their search query and serve related ads. For Amazon sellers, sponsored products feature an image, title, and price highlighting the product within the search results. This is a paid placement to promote product sales on Amazon.com.

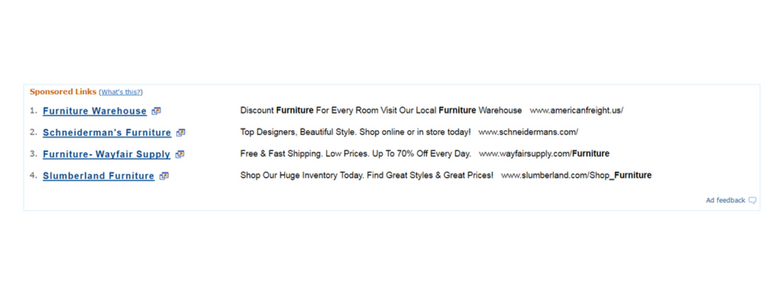

For non-Amazon sellers, sponsored links drive traffic to your website ― just like Google search advertising. The largest difference is that Amazon will serve these sponsored links at the bottom of their search results and Amazon-sponsored links will not feature any additional ad extension features that increase ad click-through rates.

The Amazon Advertising Platform also goes beyond search ads with display capabilities on Amazon.com, showing ads across Amazon devices such as Kindle products, and other sites around the web. Just like the sponsored products, the display solutions will drive traffic to your website and use shopping behavior insights to reach your ideal audience.

What This Means for Marketers

What marketers can do is ensure a positive site experience so consumers stay on site, purchase, and return. A major part of a positive website experience is site speed. A recent case study showcased that if Amazon’s site was 1 second slower to load that they could stand to lose $1.6 billion dollars in sales per year. If a page does not load fast enough, that potential sale bounces. Marketers should be looking into their page speed performance this holiday season and prioritizing any possible optimizations for improvement there. Use Google’s free PageSpeed Insights tool for a quick analysis of your website speed.

Even if you don’t sell your products on Amazon but sell products online, consider testing Amazon Advertising Platform. Amazon has years of shopping behavior data that may uncover audience insights you were not previously aware of. Test both sponsored links and display advertising to see if you can gain incremental revenue.

While Amazon is certainly taking a large share of product search traffic, Google is certainly a large player and Google Shopping should not be ignored by any ecommerce brand. There have been many advancements in Google’s Shopping features, including:

- More prominent top placement in the search engine results page (SERP)

- The addition of local inventory ads to connect online and offline sales

- Overall higher frequency of serving shopping ads in SERP

Google serves shopping ads on searches when they assume intent is to shop, especially on mobile, and Google has reported that shopping related searches have increased 120% in the last year. The fact that Google serves shopping ads at the top of the results page, and serves them more frequently, makes it an essential tactic for all ecommerce sites to be leveraging as an “always-on” execution (the investment of which should be baked into standard ongoing paid search efforts).

At Nina Hale, shopping campaign impressions have increased an average 20%-25% MoM for the past three months. Impression volume growth signifies that Google is serving shopping ads on more search queries, along with shopping queries increasing during Q4. In addition to impression growth, shopping campaigns are driving website traffic at a lower cost per click and a higher click-through rate than standard text ads. Direct factors such as shopping ad placement and ad format creates a better, more enticing shopping experience for consumers.

How to Make the Most of Google Shopping

The key to a successful Google Shopping campaign is the accuracy of the product feed or the merchant feed. The more details and categorization given to Google will increase the frequency of product ads being served. Additionally, the data has to match the website or Google will not serve the ads. It’s important to remember that shopping campaigns are not keyword-based and Google will serve the product ads on a relevant search query based on the information uploaded in the product feed. In addition to the accuracy, be sure you’re testing and optimizing the product titles, keyword-rich descriptions, and high quality images. These optimizations can lead to more clicks and ultimately more sales this holiday season.