A Marketer’s Guide to the 2024 Presidential Election

The countdown is on: we are less than one year away from the 2024 presidential election. As marketers expect with any election cycle, inventory on key channels will be limited, ad prices will be inflated, and consumer sentiment must be kept top of mind. With 2024 planning in full swing, now is the time for marketers to prepare for the election year ahead.

Consumer conversation and sentiment ahead of the 2024 election

Consumer sentiment heading into the 2024 election is largely negative, exhausted by the fact we are still discussing the last election with terms like “fraud,” “stolen,” and “interference” at the top of social mentions across platforms.

While election discussion is expected across all mediums, the velocity of these discussions varies wildly. X (formerly known as Twitter) continues to be the primary host of election-based content with over 46.5 million posts shared in the past year, followed by Instagram (893K) and Reddit (38.5K). Sentiment varies depending on where the discussion is happening. While X is shrouded with negative sentiment, TikTok is trending to be a less negative discussion ground with 61% higher positive sentiment than other platforms.

Looking back to glean insights about the future

There are two defining elements of the 2020 presidential election:

1. Political ad spending reached new levels and dominated new channels

Political ad spending jumped to new levels in 2020 as candidates spent $9 billion in the battle for the White House, of which $8.5 billion was spent across TV, radio, and digital media. For this election, politicians spent double what was spent in 2016. Broadcast TV secured 53% of the political spending, but digital secured an unprecedented 27%, with the majority being spent on social platforms.

2. Misinformation spread like a wildfire and networks scrambled to atone

Misinformation ran rampant during the 2020 election, particularly on social channels. According to the Pew Research Center, nearly three-quarters of U.S. adults (72%) noted after the 2020 election that they saw at least “some” election news that seemed completely made up. To combat the threat of misinformation, many platforms implemented guardrails. Meta blocked accounts that were promoting misinformation, YouTube removed videos that aided in the spread, and Twitter pledged to take action against false claims made on their platform.

Key predictions for the 2024 election

As we look ahead to the 2024 election, we predict it will closely resemble that of 2020.

Prediction 1: Misinformation will not only continue, it will accelerate and create further polarization

Misinformation was the defining issue that polluted much of the 2020 election — and we predict this trend will be exacerbated in 2024. Why? Many platforms previously fortified their approach against misinformation, but economic conditions have forced tech giants to roll back safeguarding against misinformation. For example:

- X, formally known as Twitter, rolled back guardrails in favor of creating a “free speech haven”

- Meta cut teams that tackled disinformation

- YouTube shared that it would no longer remove videos that “advance false claims that widespread fraud, errors, or glitches occurred in the 2020 and other past US Presidential elections”

Misinformation creates conflict and polarization, which will naturally lead to toxicity, characteristics that few brands would like to surround themselves with. Even worse, your brand could fall victim to “guilt by association” by supporting the platforms that give way to hate speech and misleading information.

What should marketers do?

Should misinformation be a primary element of the upcoming election, we anticipate a slew of negative outcomes to follow. Not only will negative sentiment continue, but consumer backlash toward both platforms and brands may occur. While we aren’t officially recommending any social abstinence, it is a conversation that may come up within your organization. Be ready for the conversation with the following guidance:

1. Avoid the most toxic of environments: While all platforms carry a risk of negative

juxtaposition, X will remain the center of political conversation and may become even less brand safe. Video-centric platforms and less conversational social experiences may be safer than those designed for conversation that could easily lead to discourse; however, given the user-generated nature of these platforms, no environment can be deemed 100% brand safe. Choose your spots, think about the brand’s own position, and evaluate risks and rewards before making drastic decisions.

juxtaposition, X will remain the center of political conversation and may become even less brand safe. Video-centric platforms and less conversational social experiences may be safer than those designed for conversation that could easily lead to discourse; however, given the user-generated nature of these platforms, no environment can be deemed 100% brand safe. Choose your spots, think about the brand’s own position, and evaluate risks and rewards before making drastic decisions.

HOT TAKE: THREADS: Threads will rival X for political conversation and grow into a sustainable, long-term alternative by 2025. While Threads hasn’t reached critical mass and does not yet have advertising opportunities, it is poised to gain ground as disenfranchised Xers may flock to the platform to have discussions in a more protected environment. Threads has the potential to gain users during the election, which will have them poised for ad support. However, the jury is out on whether they will look to capitalize on the tremendous revenue opportunity leading into peak political spending next fall.

2. Consider other channels with better contextual control: While social offers a massive amount of reach for your campaigns, there is a big internet out there and many messaging formats are available for distribution across the open web. Here are a few considerations as you head into the new year:

- Native advertising and programmatic social extension ads offer a similar creative experience to social platforms with more control over the environment. Domain lists can remove news sites in their entirety, and contextual filters can block political content or even block environments that allow any user-generated content.

- Content: Both brand-created and custom content commissioned by publishers offer a great way to control messaging across the entire page, while also offering residual SEO and inbound traffic benefits.

- Paid search provides the ultimate safe haven for advertisers. With benign environments and tight control of keywords, this landscape is the safest place for advertisers to play.

3. Remain neutral & monitor conversation: While some brands choose to tilt left or right, the best play for most brands is to remain neutral. Taking stances runs a substantial risk of alienating a large volume of consumers. If brands remain active with content during this time, it is recommended to deploy social listening and reputation monitoring to stay ahead of any sort of political backlash.

Prediction 2: Political spending will continue to soar, be more concentrated, and impact new channels

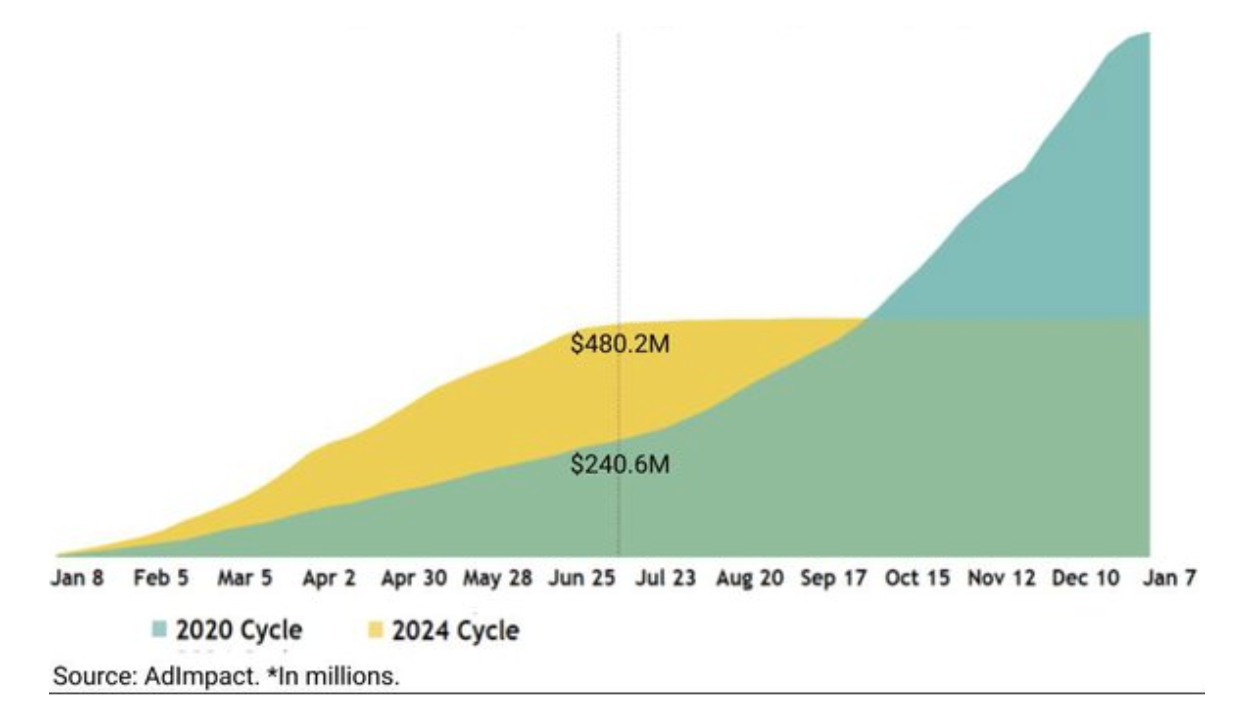

Political cycle ad spending through July 7, 2023

While the 2020 presidential election was the costliest election to date, the 2024 election looks to bust the spending ceiling once again. Since the start of 2023, all campaigns and outside groups have combined to spend nearly $70 million on advertising for the presidential race, with spending projected to top $10 billion in 2024 according to AdImpact. And this record-breaking spend is ramping up at a quicker rate than 2020. In fact, as shown in the chart above, political spending has already reached $480M for the 2024 political cycle by the beginning of July 2023, while at the same time in 2020, only $240M had been spent (AdImpact).

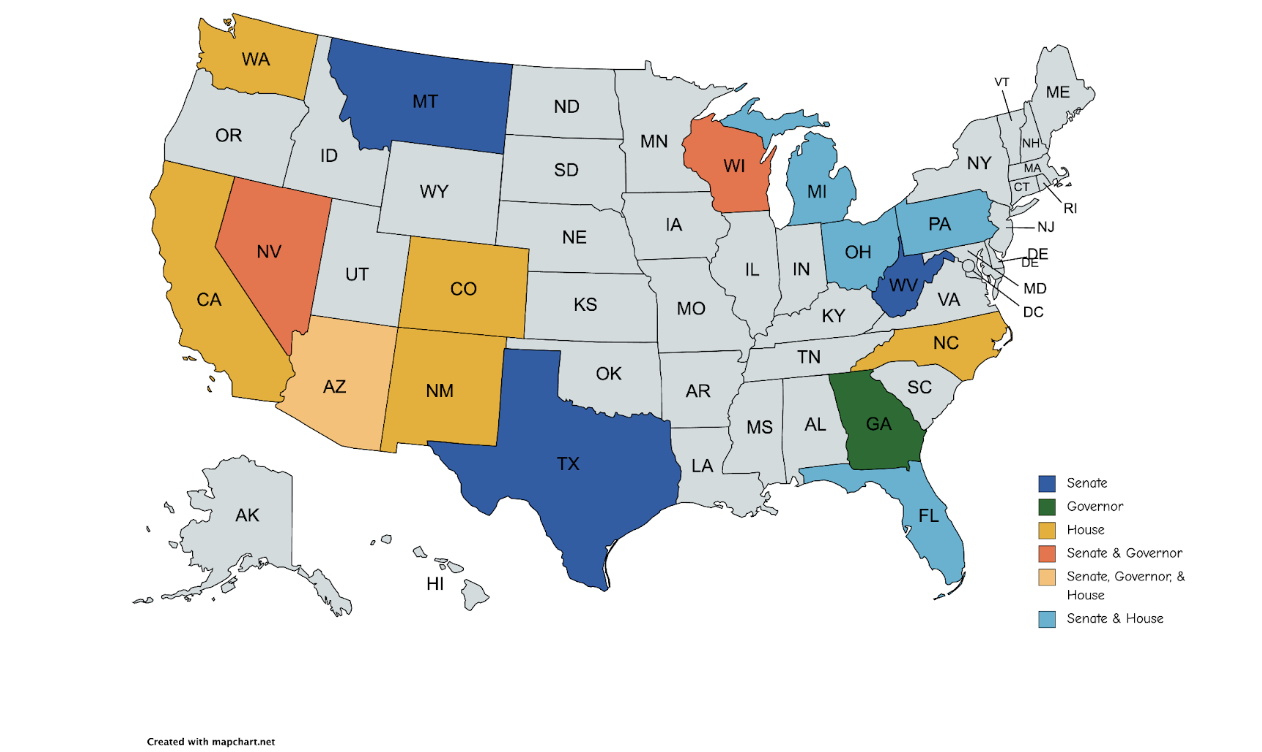

This election cycle, we will see spending in concentrated markets. For the presidential election, Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin will see disproportionate pressure as politicians push for voters’ attention within these states. Other states will see various pressures for the Senate, Governor, and House races.

Digital expenditure will continue to climb with connected TV (CTV) experiencing the most dramatic increase in ad dollars, and it will flock to the most established brands. Since 2020, there has been a dramatic increase in ad-supported CTV environments. In 2020, platforms like Peacock and Max (formally HBO Max, HBO Go, HBO Now, or HBO on demand) ad offering’s were fledgling and ad-supported users were low. However, platforms like Netflix and Disney hadn’t rolled out their offerings yet and streaming cable alternatives (dMPVDs) like Hulu + Live TV and YouTube TV were still gaining traction. Naturally, with the growth in this space, we can expect seismic growth in CTV. One silver lining for CTV is that many of these platforms only allow direct deals for political advertising. While this does not mean there will be no pressure on inventory, there will likely be a less volatile bidding environment than expected.

What should marketers do?

Record spending in concentrated timelines and heavy-ups in key states are likely to wreak havoc on the media landscape in Q3/Q4 2024 and displace plans across local markets ahead of caucuses and primaries. So, what’s a marketer to do? Here are our recommendations:

- Avoid political windows entirely: The key political windows are 60 days before the general election and 45 days before the primary election. During these windows, broadcasters are required to offer qualified candidates “lowest unit rate” and political advertisers are prioritized for air over commercial advertisers. This means that the potential for preemption is high unless advertisers are willing to pay top dollar to preserve their spot. While avoiding broadcast television during the political window is the primary recommendation, our experts recommend brands highly scrutinize all investment choices during that time period and prepare for increased rates across all channels.

- Stewarding TV buys during political windows: Marketers should aim to avoid broadcast television during political windows or heavily temper expectations for delivery. While most are cognizant of this during the general election window, marketers should be mindful of this during the primary windows as well. If brands must be on during this period, ensure you or your media partner are monitoring clearing (the portion of booked inventory that actually runs) daily with stations to attempt to move weight in flight or credit spend in real time for reallocation. If brands have a different TV and digital buying group, connect your partners directly as preempted spend can be quickly moved to digital channels to ensure delivery goals are still met during critical business time periods.

- Consider alternatives to spot TV: Political campaigns may bump commercial advertisers automatically, meaning it isn’t just expensive to run during these times, but also that advertisers may simply not be able to deliver the purchased weight. If brands are a direct response TV advertiser, expect what actually runs from your planned amount to be extremely low. To combat this, consider alternatives to traditional linear TV such as connected TV, online video, or YouTube. These channels have significantly more scale than broadcast and are not governed by political guidelines, which levels the playing field for bidding opportunities.

- Dial in on CTV: Deep knowledge of inventory management, exploring inventory guarantees (programmatic guaranteed or direct buys), and daily management of CTV are the keys to success. But to reap the benefits of this channel in 2024, brands must explore opportunities on this channel now. We expect that household names like Netflix and Disney will be swamped with political ads, while lesser known streaming services and apps may contain troves of effective inventory. Programmatic guaranteed deals or direct buys, while more costly than private marketplaces (PMPs) or open real-time bidding (RTB) programmatic deals, can offer guaranteed rates and non-preemptable video inventory, which not only hedges the unknowns of auction economics but can also ensure on-air slots for brands during business-critical time periods.

- Auction-based media: Inventory costs may increase due to the influx of political ad dollars, and performance may be down when comparing historical performance during this timeframe. Marketers must ensure expectations are set within your organization and consider adjusting performance benchmarks during political windows. Reviewing key metrics, such as cost per thousand impressions, cost per click, cost per acquisition, and return on ad spend with executives and estimating the impact with simple heuristics can help mitigate disruption. To ease disruption further, we also recommend testing new channels ahead of political windows. This helps provide brands with more options for budget reallocation if one of their “proven” channels is disproportionately impacted by the election cycle.

What marketers need to know going into the 2024 election

The 2024 election cycle is riddled with considerations for marketers as annual plans are finalized. When considering how to best protect your marketing efforts in the year ahead, here are our core recommendations:

- Plan ahead to limit the scramble: Work with your agency to plan for the impact of the election. Now is the time to set expectations internally with key stakeholders, adjust benchmarks, move flighting, and reallocate away from heavily impacted channels.

- Keep the consumer at the core of marketing efforts: Negative emotions will skyrocket as the election creeps closer. It is important to evaluate the impact this may have when users engage with your brand. Understanding where election conversations are taking place will give marketers a leg up in reviewing their own approach before and during this election cycle. Social listening and reputation management can position brands to lead the conversation rather than react to it.

- Remain agile: As political ad spending continues to increase, ad prices will inflate and inventory will be limited. Brands must prepare for their campaigns to be “bumped” and/or for clutter to increase on coveted mediums. To combat rising costs and inventory reductions, marketers must infuse agility within their marketing plans to ensure disruptions are navigated with ease. Ensure plans are not executed in a silo, and be ready to shift budget across channels. To do this nimbly, we suggest connecting your traditional and digital agencies directly or breaking down internal silos to create a seamless approach.